In today’s real estate market, many prospective homebuyers are wondering if it’s the right time to take the plunge. With so many waiting for interest rates to drop significantly, demand has cooled, creating a unique window of opportunity for savvy buyers. Here’s why buying now could be a smart move, even if mortgage rates are higher than you'd like.

Sellers are keen to move their properties, and with fewer buyers competing, you have a better chance of negotiating favorable terms. In a high-demand market, buyers often face bidding wars and reduced leverage when it comes to negotiating price, repairs, or closing costs. But in today’s slower-paced environment, sellers may be more willing to negotiate on price or offer incentives such as covering closing costs or offering home warranties. You could walk away with more than just a great home—you might secure a deal that would have been hard to achieve a year ago.

One of the major benefits of buying in a slower market is reduced competition. Homes aren’t flying off the market as quickly, giving you more time to evaluate your options without the pressure of making an immediate offer. You can be more selective and make a decision that truly suits your needs, rather than rushing into a purchase just to secure a property. You can also avoid the stress and disappointment that come with losing a home to another bidder.

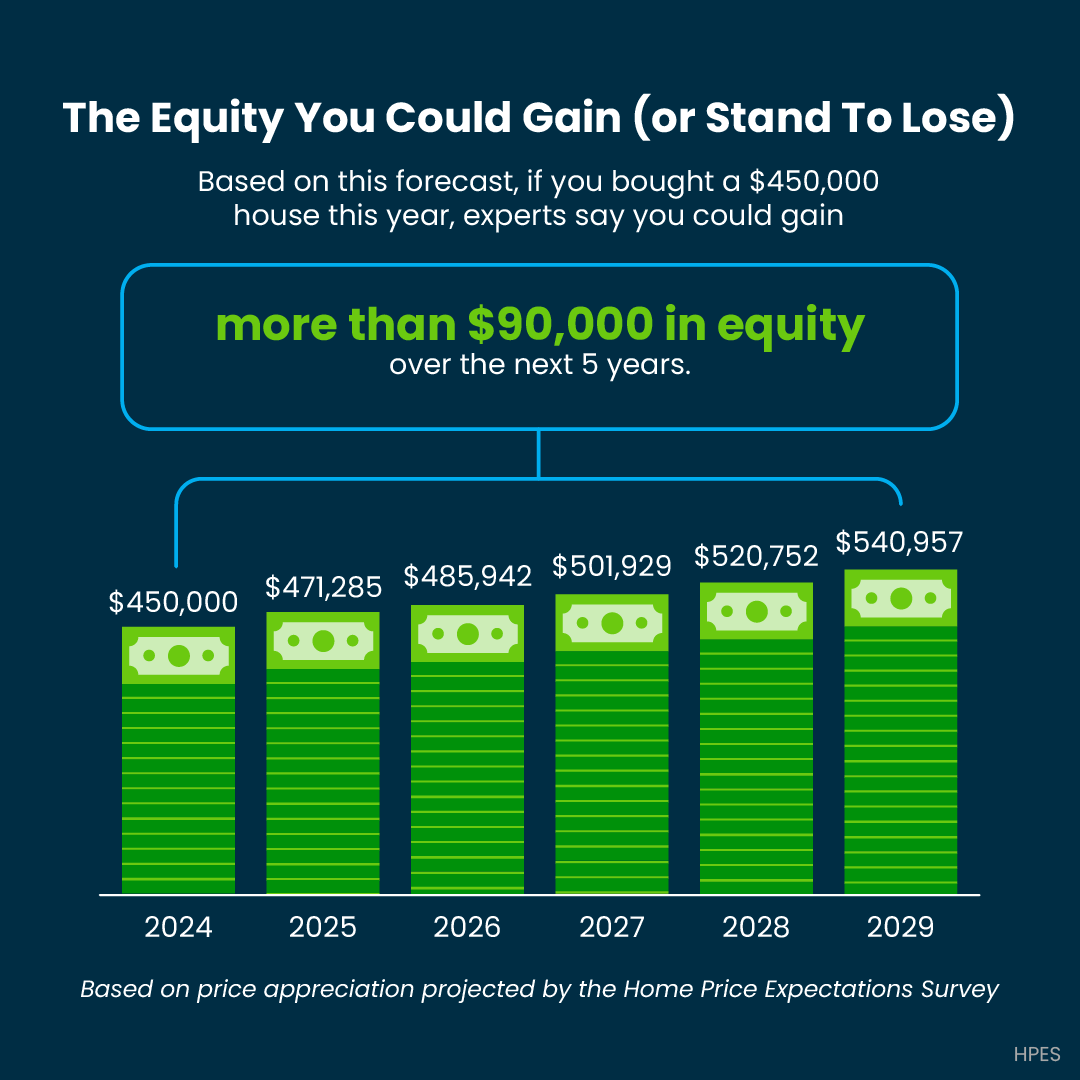

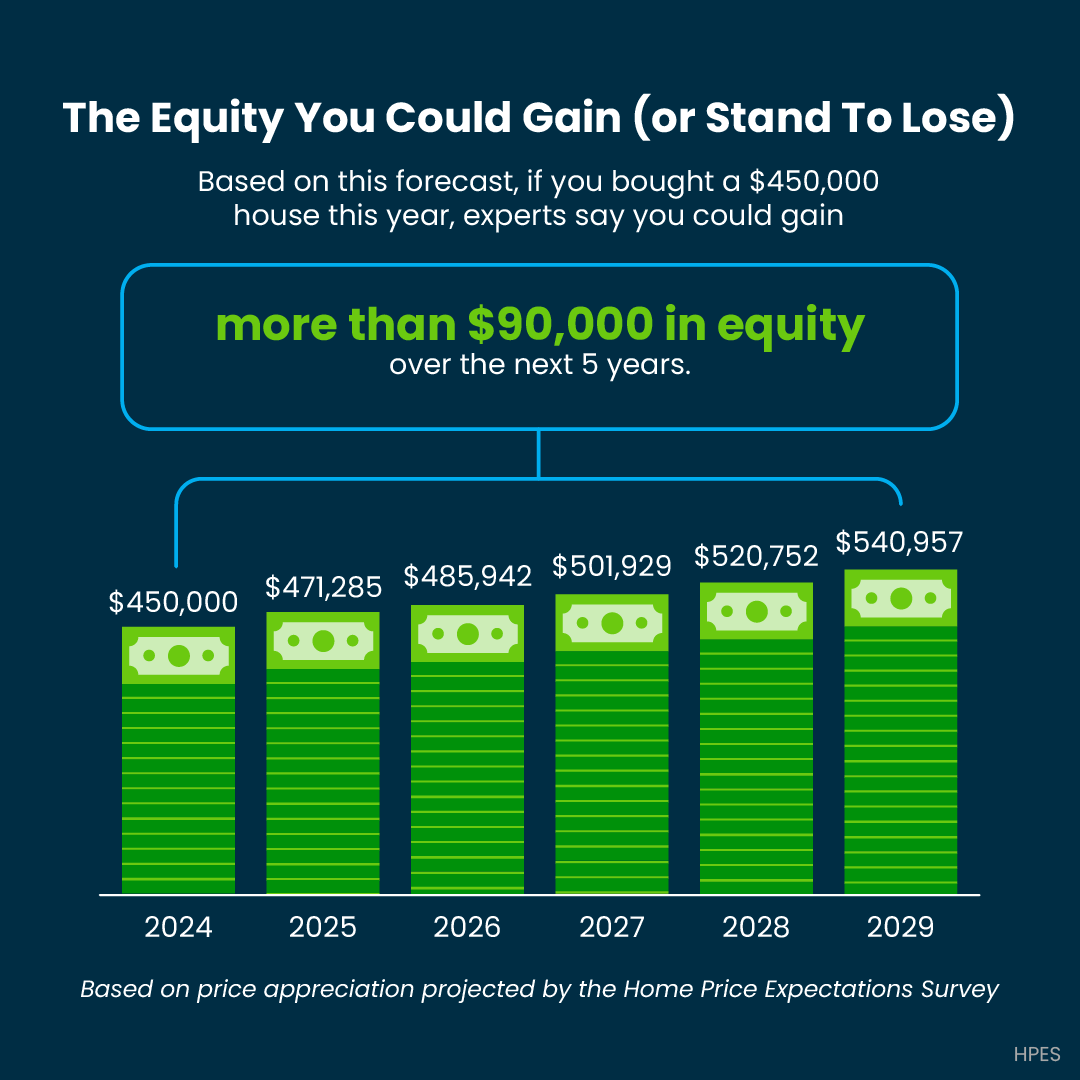

While interest rates may be higher than they were in previous years, they have recently dipped below 6%, marking the lowest point in over 18 months. If you can afford the mortgage payment, taxes, insurance, and maintenance costs, buying now still allows you to start building equity immediately. Plus, if rates drop in the future, you’ll have the option to refinance and lower your monthly payments.

Historically, mortgage rates in the 3%-4% range are outliers rather than the norm. Since the 1970s, rates have generally hovered around 6%, meaning the current market isn't as abnormal as it may seem. Waiting for a major drop could leave you on the sidelines while others seize the opportunity.

The housing market is cyclical, and conditions can change quickly. While many are waiting for “perfect” conditions, there’s no guarantee they’ll arrive. In fact, waiting too long could mean missing out on the best time to buy. With sellers willing to negotiate and less competition for homes, now could be the right time to find a home that fits your needs—and your budget.

If you’re financially prepared and ready to make a move, the current market conditions offer a unique advantage for buyers. Don't let the uncertainty around rates keep you from exploring your options. This could be your opportunity to secure a home and begin building equity, while positioning yourself to refinance down the line if rates fall further.

Know someone that is ready to explore their options? We would love to help them navigate the market!

Sellers are keen to move their properties, and with fewer buyers competing, you have a better chance of negotiating favorable terms. In a high-demand market, buyers often face bidding wars and reduced leverage when it comes to negotiating price, repairs, or closing costs. But in today’s slower-paced environment, sellers may be more willing to negotiate on price or offer incentives such as covering closing costs or offering home warranties. You could walk away with more than just a great home—you might secure a deal that would have been hard to achieve a year ago.

One of the major benefits of buying in a slower market is reduced competition. Homes aren’t flying off the market as quickly, giving you more time to evaluate your options without the pressure of making an immediate offer. You can be more selective and make a decision that truly suits your needs, rather than rushing into a purchase just to secure a property. You can also avoid the stress and disappointment that come with losing a home to another bidder.

While interest rates may be higher than they were in previous years, they have recently dipped below 6%, marking the lowest point in over 18 months. If you can afford the mortgage payment, taxes, insurance, and maintenance costs, buying now still allows you to start building equity immediately. Plus, if rates drop in the future, you’ll have the option to refinance and lower your monthly payments.

Historically, mortgage rates in the 3%-4% range are outliers rather than the norm. Since the 1970s, rates have generally hovered around 6%, meaning the current market isn't as abnormal as it may seem. Waiting for a major drop could leave you on the sidelines while others seize the opportunity.

The housing market is cyclical, and conditions can change quickly. While many are waiting for “perfect” conditions, there’s no guarantee they’ll arrive. In fact, waiting too long could mean missing out on the best time to buy. With sellers willing to negotiate and less competition for homes, now could be the right time to find a home that fits your needs—and your budget.

If you’re financially prepared and ready to make a move, the current market conditions offer a unique advantage for buyers. Don't let the uncertainty around rates keep you from exploring your options. This could be your opportunity to secure a home and begin building equity, while positioning yourself to refinance down the line if rates fall further.

Know someone that is ready to explore their options? We would love to help them navigate the market!

NAR Settlement: What does this lawsuit mean for you when buying a property?